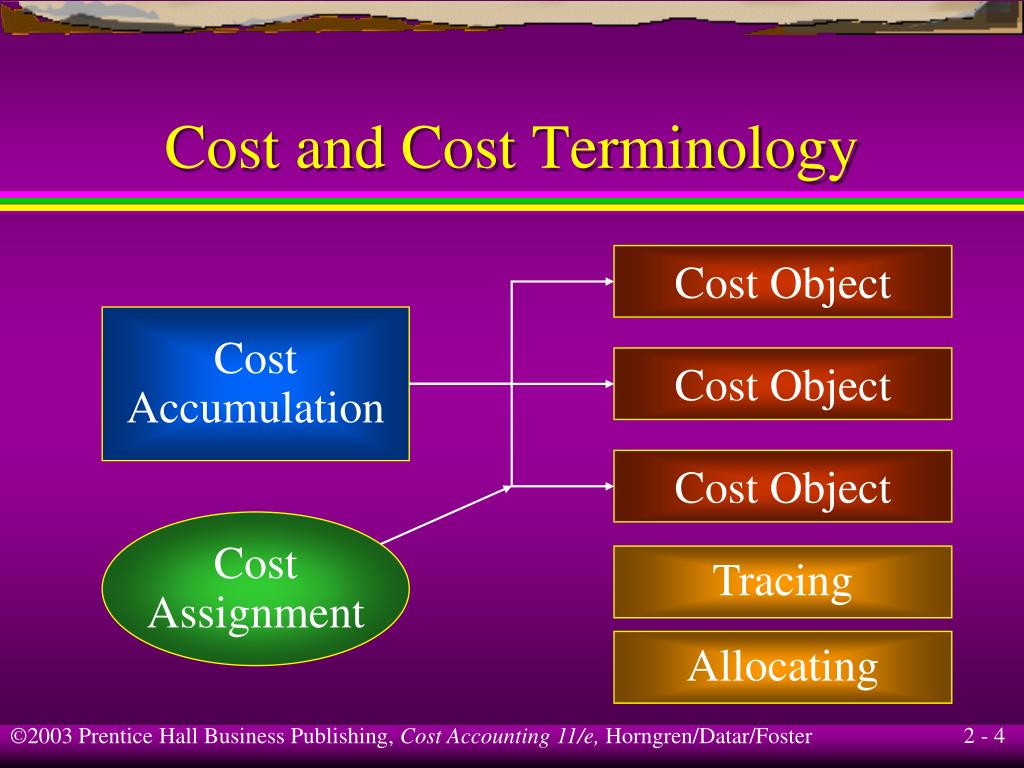

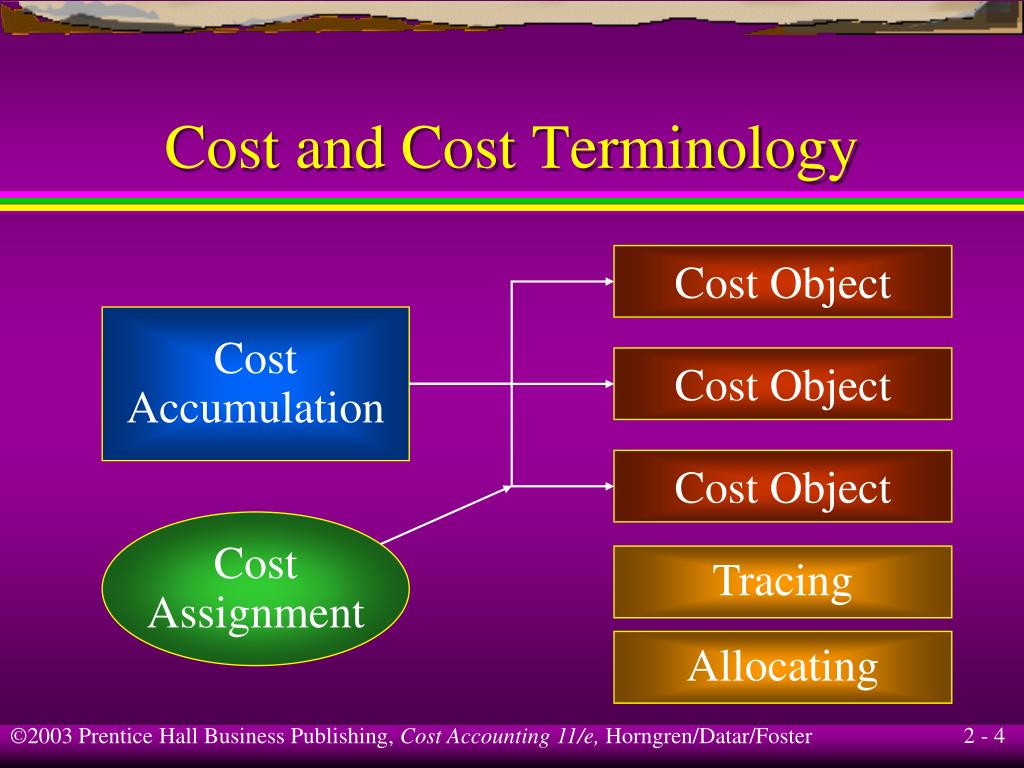

The IT department can measure some costs for individual cost centers directly. This arrangement is typical for IT departments, for instance, that provide support to other cost centers in the company. Organizations that support other organizations throughout the business may have to cross-charge their internal clients for services. Allocating Internal Cross Charge Costs for Support Services The difference between direct and indirect (overhead) costs has to do with the firm's ability to assign cost figures to individual product units, service deliveries, sale closings, or organizations. Examples showing how Activity Based Costing sometimes serves as an alternative to allocation approaches, essentially by turning direct costs into direct costs. Showing how cost allocation works in assigning value to indirect costs. Explaining cost allocation and cost apportionment principles. Sections below further define and illustrate cost allocation and cost apportionmentin context with similar terms and concepts, focusing on four themes: Explaining Allocation and Apportionment in Context Ĭosting examples below use cost objects familiar to manufacturing firms, but the principles apply to many other settings and their cost objects as well. This practice contrasts with the non-traditional approach, Activity-Based Costing, which tries to value all costs-direct and indirect-by measuring actual resource usage. Traditional cost accounting may assign specific cost figures by somewhat arbitrary allocation or apportionment rules. The method is a central component of traditional costing. Mainstream costing methods include Cost allocation, a method for assigning values to certain cost objects, especially those that incur "indirect" costs. In most businesses, responsibility for finding and assigning cost values falls primarily on the firm's cost accountants. It is no overstatement to say that comprehensive, accurate costing is indispensable for running a successful business. Trustworthy costing is equally essential for other core activities throughout the organization-measuring business performance, analyzing operations, managing the asset lifecycle, setting prices, validating the business model, and optimizing inventory flow, to name a few.

Accurate budgets and feasible plans are next to impossible without plausible cost figures for a wide range of cost objects. What Are Cost Allocation and Apportionment? Cost accountants sometimes use allocation rules to assign the so-called indirect costs.Ĭost questions that need answers turn up in abundance when an organization engages in budgeting or planning.

Traditional Costing vs Activity-Based CostingĬopyright © 2022 Solution Matrix Ltd All Rights Reserved

0 kommentar(er)

0 kommentar(er)